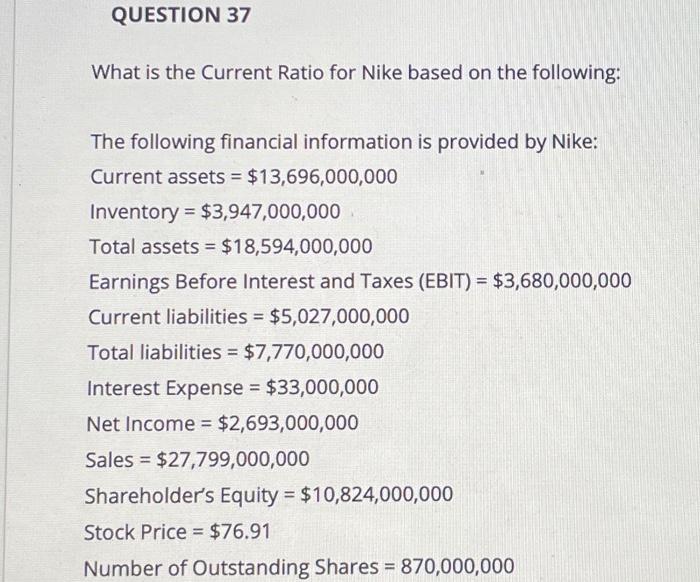

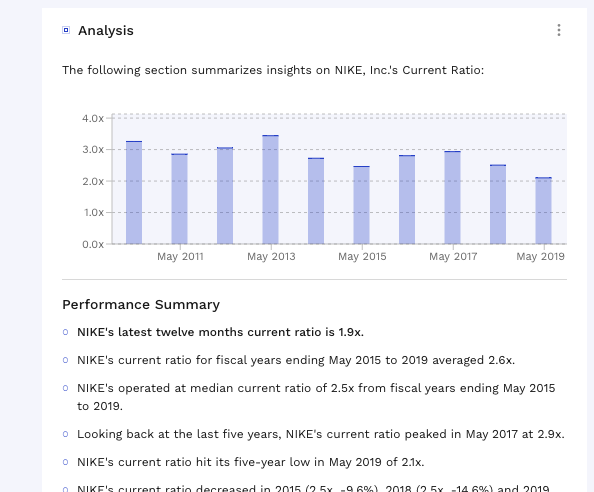

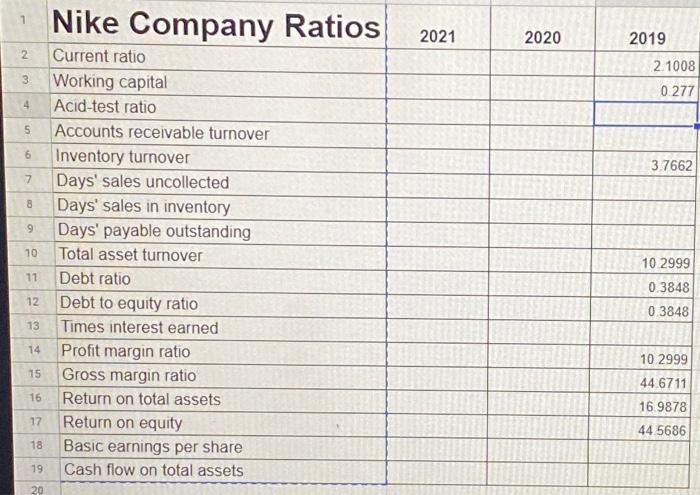

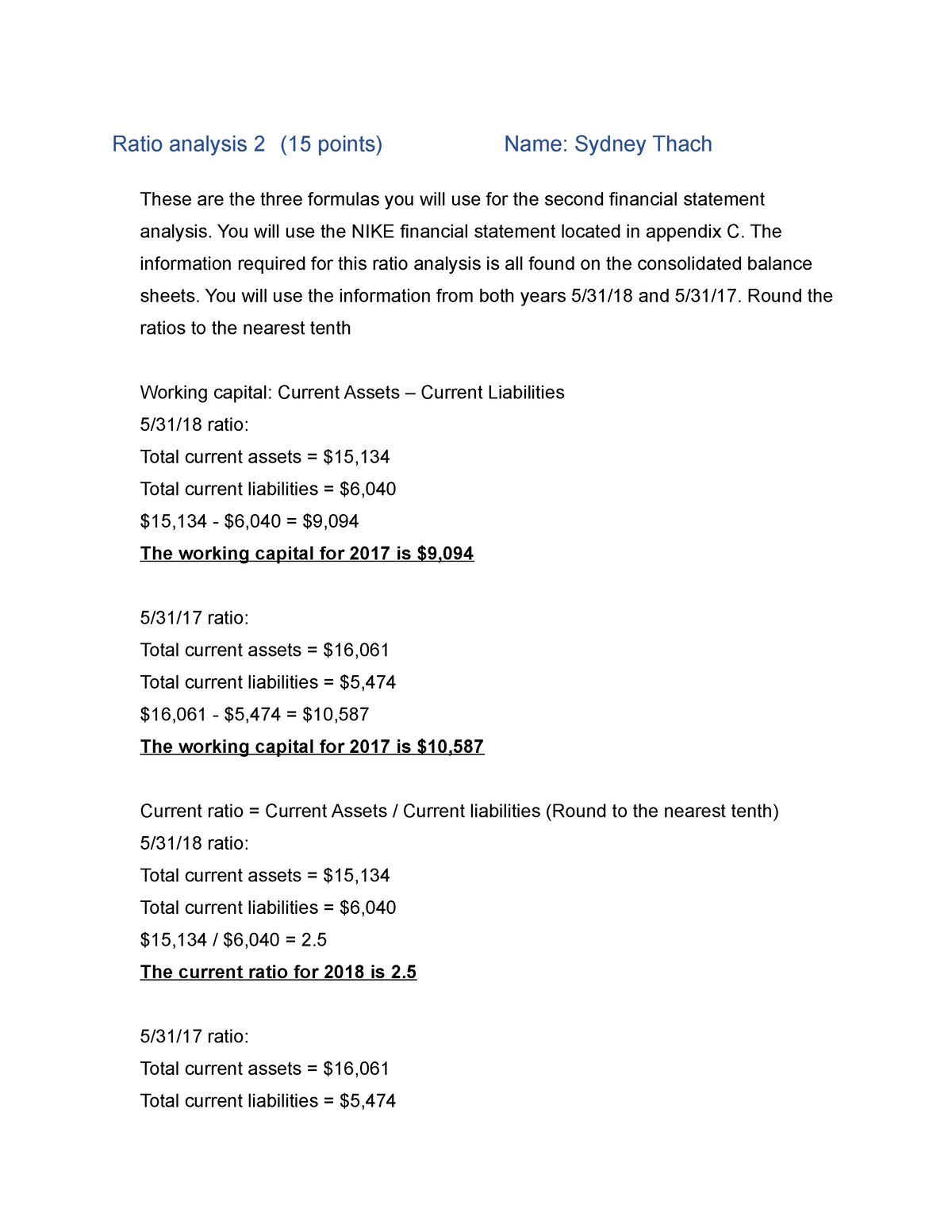

FS 2 working capital, current ratio, quick ratio - Ratio analysis 2 (15 points) Name: Sydney Thach - Studocu

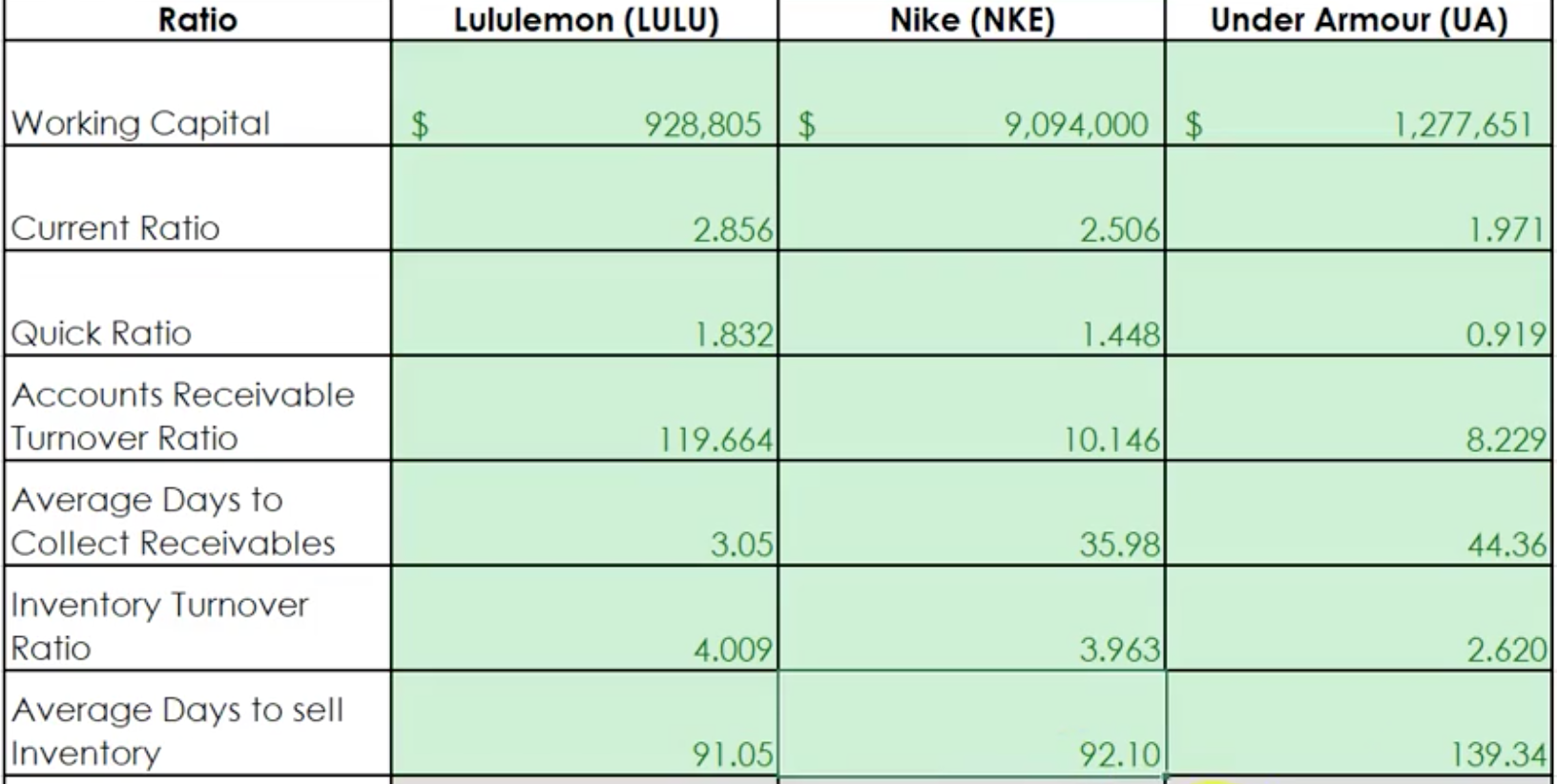

The calculation results of five main efficiency ratios of Nike Inc. in... | Download Scientific Diagram

PDF) STUDY OF RELATIONSHIP BETWEEN LIQUIDITY RISK(QUICK RATIO) AND INTERNAL AND EXTERNAL FACTORS IN NIKE COMPANY

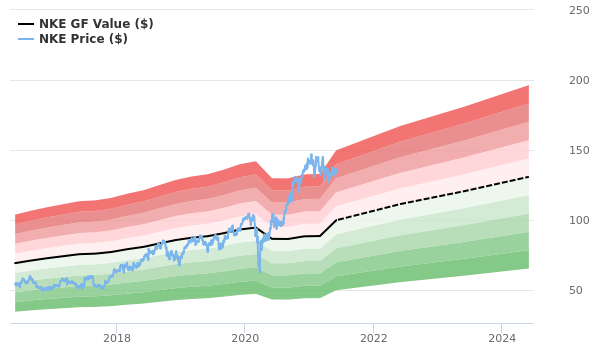

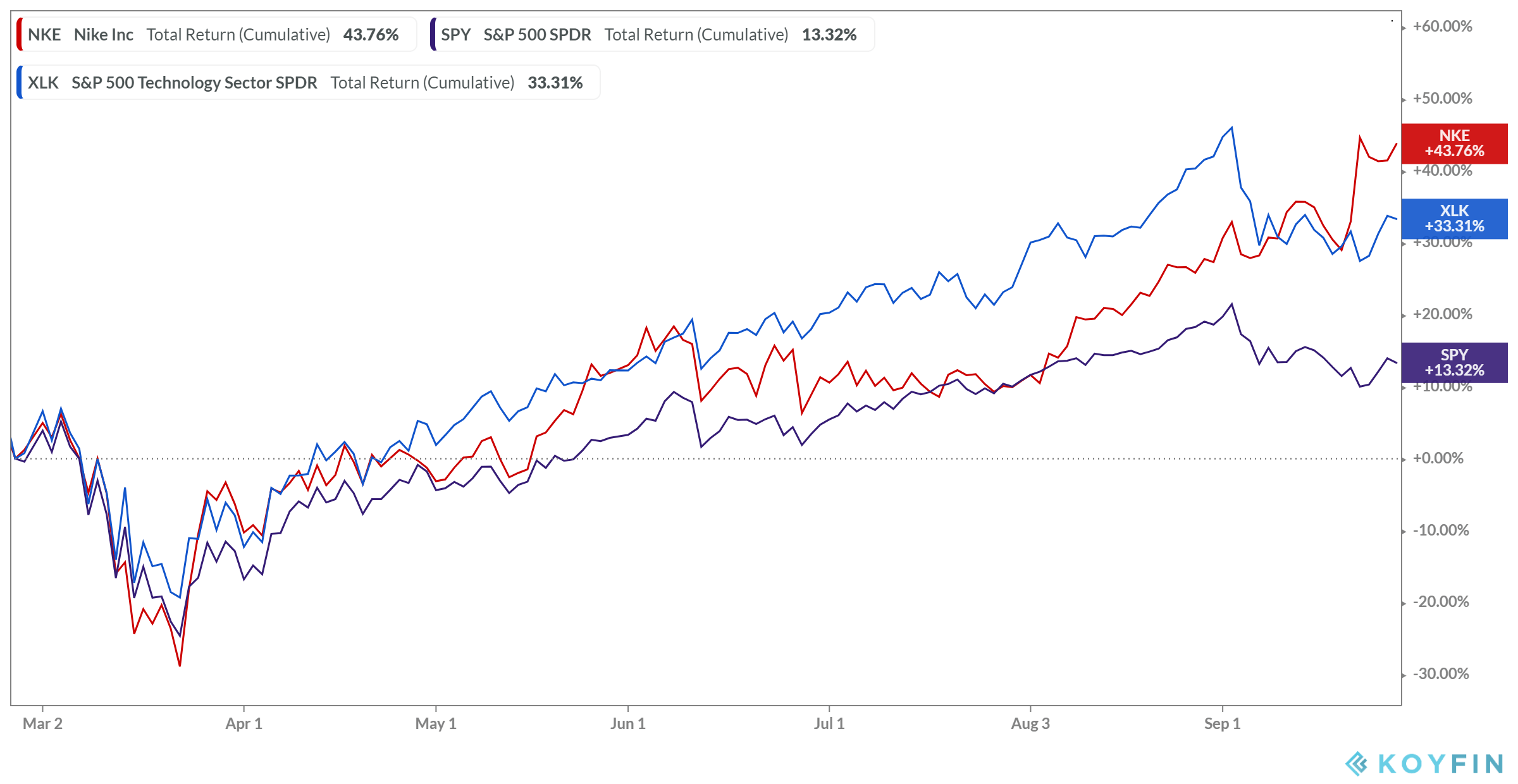

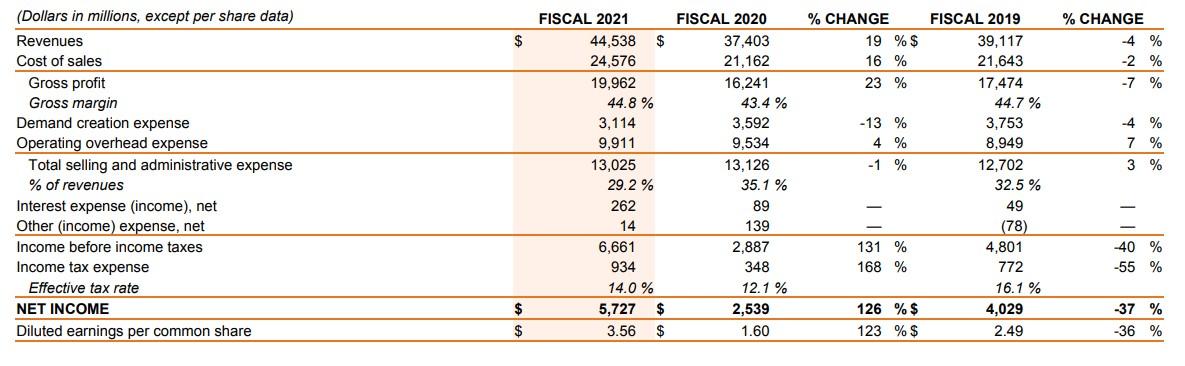

Four Things to Consider When Investing in a Company: A Nike Case Study | by World Business Bites | Medium